The Internal Revenue Service has confirmed that the 2026 federal tax filing season will officially begin on January 26, 2026, when the IRS begins accepting and processing individual income tax returns for tax year 2025. Taxpayers should prepare now to ensure an accurate and timely filing.

When the IRS Starts Accepting Returns

The IRS will start accepting 2025 individual tax returns on January 26, 2026. This is the earliest date taxpayers can submit their federal income tax returns for processing. Most taxpayers who plan to file electronically or through tax professionals will follow this launch date.

Deadline to File and Pay Taxes

Federal individual income tax returns for the 2025 tax year are due on April 15, 2026. Filing by this date helps taxpayers avoid penalties and interest. If taxpayers cannot complete their return by April 15, they can file Form 4868 with the IRS to request an automatic extension. Note that requesting an extension extends the time to file, not the time to pay any tax owed.

Documents You Should Gather Now

To file efficiently when the season opens, taxpayers should collect:

W-2 wage and tax statements from employers

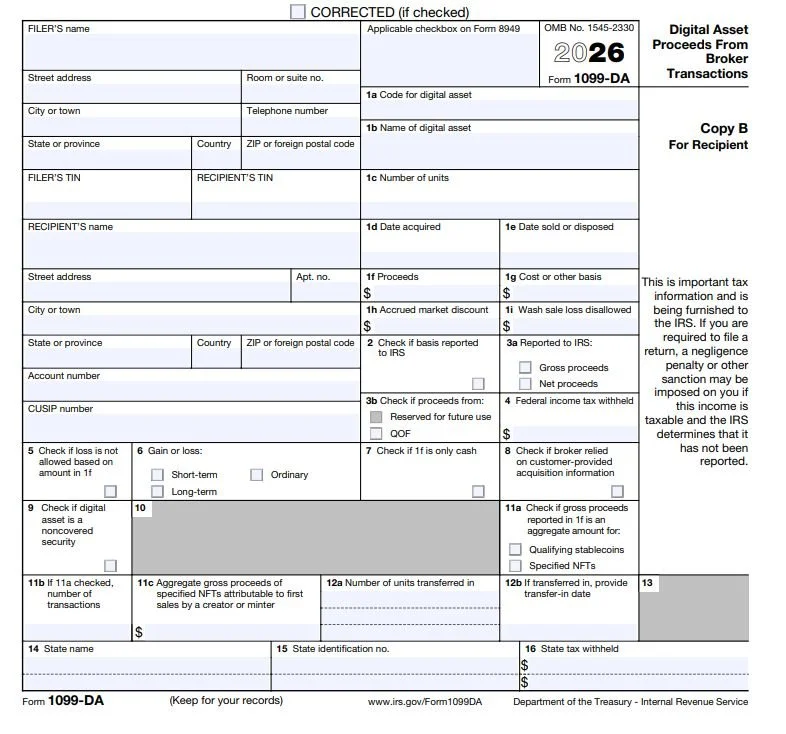

From the 1099 series for interest, dividends, retirement distributions, and contractor income

Receipts for deductible expenses such as charitable contributions and qualified education costs

Records of estimated tax payments made during 2025

You can also download our free Tax Organizer Checklist by Filing status here to help stay organized: Tax Organizers & Forms

Changes to Refund Delivery and Filing Options

For the 2026 filing season, the IRS will emphasize electronic filing and direct deposit for refunds as the agency phases out paper refund checks. Taxpayers should ensure their bank information is accurate when filing to receive refunds quickly and securely.

The IRS Free File program remains available to eligible taxpayers with adjusted gross incomes below certain thresholds, offering a free option to prepare and submit their federal returns electronically.

Plan for Estimated Payments

The fourth quarter estimated tax payment for the 2025 tax year is due January 15, 2026. Taxpayers who are self-employed or have other income without withholding should not overlook this deadline to avoid underpayment penalties.

New Client Incentive

New clients who switch to JCox CPAs & Advisors, P.C. receive 30% off their first year of services, plus a complimentary tax planning report at onboarding and a mid year tax planning review. This proactive approach helps identify tax savings opportunities early and adjust strategies before year-end.