What Parents Need to Know About the New Child Investment Accounts

America has introduced one of the most significant financial tools for families in decades. Through the One Big Beautiful Bill Act and the launch of Invest America, every child under 18 years old with a Social Security number now has access to a long-term investment account that grows over time. The program provides either a $1,000 federal deposit for new births beginning in 2025 or a $250 deposit for children 10 and younger, funded by Michael and Susan Dell. These accounts give families a new way to build generational financial security.

This blog breaks down exactly how the program works, who qualifies, and how families can benefit from it, both practically and from a tax perspective.

What Is Invest America

Invest America is a national savings and investment initiative overseen by the United States Treasury. According to the official program fact sheet, every child under age 18 with a Social Security number is eligible for an account, and parents activate the account directly through the Treasury. The accounts are low-cost, professionally managed, and regulated for safety and transparency.

These accounts are designed to give children a long-term savings platform that can be funded by parents, relatives, employers, and, in some cases, philanthropic contributors.

These new child investment accounts are referred to in three different ways, and all three names describe the same program. The official government name is Invest America Accounts. This is the name used by the United States Treasury and in the program’s published fact sheet. Many parents and news outlets call them Trump Accounts because the program was created and funded under the One Big Beautiful Bill Act. The technical tax code name is 530A Accounts, which is the formal classification adopted by Congress, similar to how 529 plans are labeled in the tax code.

The Two Funding Paths: Federal $1,000 Deposit and Dell $250 Deposit

Children Born On or After January 1, 2025

Children born in 2025 or later automatically receive a $1,000 contribution from the United States Treasury after the parent activates their account. Families and community members may contribute up to $5,000 per year, and employers may also contribute as an employee benefit. State governments, local governments, and philanthropic groups may contribute without limit, and these contributions do not affect the family’s $5,000.

Children Born Before 2025

Twenty-five million children who are age ten or younger may receive a $250 initial deposit funded by the Dell family once the parent activates the account. Priority is given to younger children if funding demand exceeds the available funds. Children who receive the federal $1,000 newborn deposit do not qualify for this $250 contribution. If any funds remain after younger children receive deposits, eligibility may expand to older children.

How Children Can Use the Funds at Age 18

Beginning at age eighteen, a child can use a portion of the account balance for major early adulthood opportunities, such as:

(a) Education or technical job training

(b) Starting a small business

(c) Purchasing a first home

Any unused funds are automatically converted into a traditional IRA, allowing the money to continue growing tax-deferred. This provides a dual benefit: early life opportunity combined with retirement security.

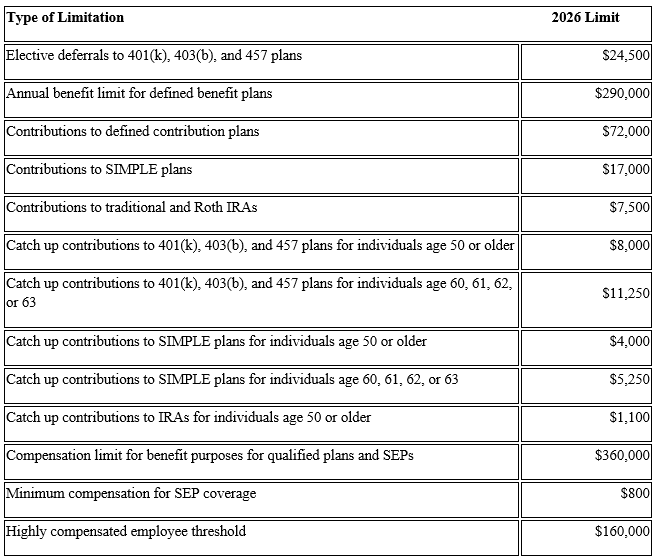

Tax Rules You Should Understand

Below is the tax interpretation based on the One Big Beautiful Bill Act and the Internal Revenue Code.

Child Tax Credit Increase

The Child Tax Credit under Internal Revenue Code section 24 will be $2,200 per eligible child in tax year 2025. The refundable portion will be $1,700. Adjustments for inflation begin in 2026. Although this credit is separate from Invest America, many families will direct their tax savings into these accounts.

Tax Treatment of Deposits

i. Federal and Dell contributions are treated as non-taxable gifts under Internal Revenue Code section 102.

ii. Family contributions are considered gifts to the child and follow the annual gift exclusion rules under section 2503.

iii. Employer contributions are not treated as wages and are deductible to the employer under section 162.

iv. Philanthropic contributions remain completely non-taxable to both the parent and the child.

Tax Treatment at Age 18

When the account becomes a traditional IRA, all IRA rules apply under Internal Revenue Code section 408. Certain withdrawals for education, first home purchases, or qualified training programs may avoid early withdrawal penalties.

Why This Program Matters for Families

Structured Wealth Building from Birth

Invest America gives families a federally guided, professionally managed investment opportunity that starts at birth and continues into adulthood.

A New Tool for Narrowing Wealth Gaps

The fact sheet emphasizes that these accounts help strengthen financial confidence, expand long-term opportunity, and support economic mobility.

Employer and Community Involvement

Employers can contribute as a benefit, and philanthropic groups can support large numbers of children without contribution limits.

Financial Education Opportunity

Parents can involve their children in tracking the account’s growth over time, giving them real-world exposure to saving and investing.

When Accounts Go Live

According to the most recent federal guidance, Trump Accounts are expected to open for parent activation on July 4, 2026. This is the anticipated date when the United States Treasury will begin allowing parents and guardians to establish Invest America accounts and receive the initial federal or philanthropic deposits. The Treasury has not yet released the official activation portal or enrollment link. This blog will be updated as soon as the Treasury publishes the final instructions and access page.

How Long Does the Program Last

Trump Accounts are currently authorized only for children born within a limited window of 2025 through 2028. The law does not guarantee that children born after 2028 will receive a federal seed deposit, and the continuation or expansion of the program will depend on future legislation. Existing accounts for eligible children remain valid, but future eligibility may change if new laws are enacted or administrations adjust program priorities.

Steps for Parents

Activate the account through the Treasury once the platform goes live.

Confirm whether your child receives the $1,000 federal deposit or the $250 Dell deposit.

Consider setting up consistent contributions during the year.

Involve employers or relatives who want to contribute.

Begin planning now for how funds may support education, business building, or a first home at age eighteen.

Important Notice: The United States Treasury has not yet released the activation portal for Trump Accounts. Parents will be able to activate accounts once the Treasury publishes the official link, which has not gone live at this time.

REVISED DATE: 12/2/2025

Source: IA-FactSheet-Parents DEC 2025 & Notice 2025-68