Our current turnaround times are as follows:

Individual Income Tax Returns: 4 days

Partnerships, C-Corporations, and S-Corporations: 4 days

These timeframes encompass thorough review and quality control processes, ensuring that your tax filings are both prompt and precise.

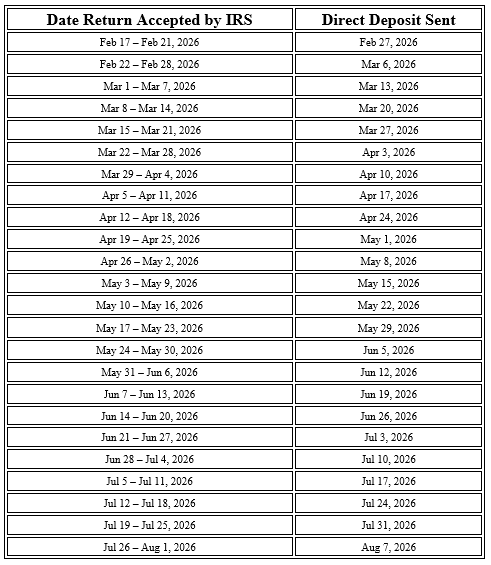

Understanding the timeline for receiving your tax refund is crucial for financial planning. The IRS typically issues refunds within 21 days after accepting an electronically filed return.

To provide a clearer picture, here's an estimated timeline for 2026 tax refunds based on the IRS acceptance date of your e-filed return: