The Internal Revenue Service has released updated retirement plan contribution limits to reflect cost-of-living adjustments under the Internal Revenue Code (Notice 2025-67). These changes impact employee deferrals, catch-up contributions, employer contributions, and IRA planning and are especially important for year-end tax planning.

2026 401(k), 403(b), and 457(b) Contribution Limits

Under Internal Revenue Code Section 402(g), the maximum elective deferral limit for 2026 is $24,500. This limit applies in total across all employer-sponsored retirement plans and includes both traditional and Roth deferrals. Contributions to traditional 401(k) plans are made on a pretax basis and reduce taxable income in the year of contribution, while Roth contributions are made with after tax dollars but allow for tax free growth and distributions if requirements are met.

Catch Up Contributions for Individuals Age 50 and Older

Internal Revenue Code Section 414(v) allows individuals aged 50 or older to make additional catch-up contributions. For 2026, the standard catch-up contribution is $8,000. In addition, individuals ages 60 through 63 may qualify for an enhanced catch-up contribution of $11,250 if the retirement plan allows it.

Beginning in 2026, the SECURE 2.0 Act requires that catch-up contributions for employees with prior year wages exceeding $150,000 be designated as Roth contributions. If an employer plan does not allow Roth catch-up contributions, these individuals may not be able to make catch-up contributions at all.

Total Annual Contribution Limit

Internal Revenue Code Section 415(c) limits the total amount that can be contributed to a participant’s retirement account in a single year. For 2026, the total contribution limit is $72,000. This includes employee deferrals, employer matching contributions, profit-sharing contributions, and forfeitures. Catch-up contributions are not included in this limit.

IRA Contribution Limits

Under Internal Revenue Code Section 219, the contribution limit for traditional and Roth IRAs for 2026 is $7,500. Individuals aged 50 or older may contribute an additional $1,100 as a catch-up contribution. Eligibility to deduct traditional IRA contributions or to contribute to a Roth IRA is subject to modified adjusted gross income limits.

Income Phase Outs and Planning Considerations

Taxpayers covered by a workplace retirement plan may have their traditional IRA deduction phased out at higher income levels. Roth IRA contributions are also subject to income-based phase-outs. Taxpayers whose income exceeds Roth IRA limits may still consider a backdoor Roth IRA strategy, subject to Internal Revenue Code Section 408A.

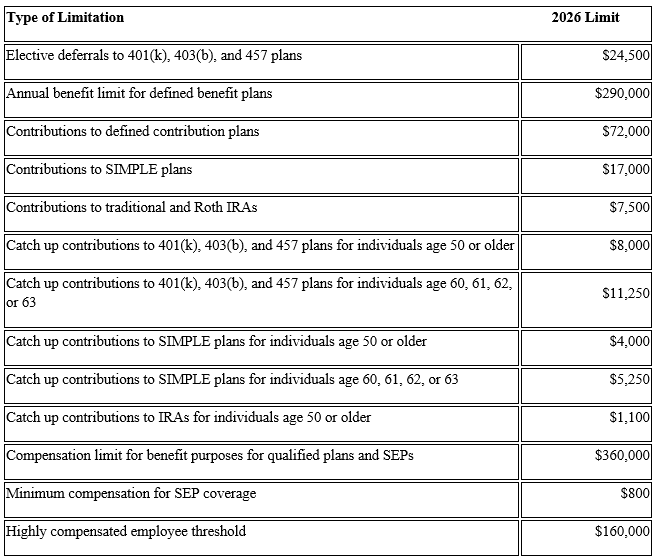

2026 Retirement Plan Contribution and Benefit Limits Summary

Action Steps for 2026

Taxpayers should consider maximizing their retirement contributions to take advantage of tax-deferred growth and current-year tax savings.

Employers should review plan documents to ensure compliance with Roth catch-up rules and SECURE 2.0 requirements. Coordinating employer plan contributions with IRA strategies can significantly enhance long-term retirement outcomes.