The Internal Revenue Service (IRS) recently issued updated guidance (FS-2025-08, Oct. 2025) clarifying how individuals, businesses, and third-party settlement organizations must handle Form 1099-K, Payment Card and Third-Party Network Transactions, under the One Big Beautiful Bill (OBBB). These changes aim to simplify compliance and provide clear direction after years of shifting reporting thresholds.

1. Key Reporting Thresholds

The OBBB retroactively reinstated the pre-American Rescue Plan Act (ARPA) threshold for third-party settlement organizations (TPSOs).

New rule: A TPSO is only required to issue Form 1099-K if the gross amount of payments made to a payee exceeds $20,000 and the number of transactions exceeds 200 during the calendar year.

Prior rule: ARPA had lowered this to $600 for any number of transactions, creating confusion and administrative burden.

Note: Individual states may impose lower thresholds, so it’s important to review your local reporting requirements

2. Who Must File Form 1099-K

Under IRC § 6050W, Payment Settlement Entities (PSEs), including merchant acquiring entities and TPSOs such as payment apps or online marketplaces, must file Form 1099-K to report certain payments for goods and services.

Merchant acquiring entities must report all payment-card transactions—there is no de minimis exception. Even a $0.01 credit-card payment triggers reporting.

TPSOs only report when both the $20,000 and 200-transaction thresholds are met. However, they may choose to file for lower amounts voluntarily

Foreign PSEs and governmental units are also covered by these requirements if they settle reportable payment transactions involving U.S. taxpayers.

3. Filing Deadlines

The IRS provides strict due dates for filing and furnishing Form 1099-K:

To payees (Copy B): Must be provided by January 31 of the year following the transactions.

To the IRS:

Paper filers – due February 28

Electronic filers – due March 31

Any entity filing 10 or more information returns during a calendar year must file electronically through the IRS Information Returns Intake System (IRIS) or the FIRE System

4. Backup Withholding and TIN Verification

If a payee fails to provide a correct Taxpayer Identification Number (TIN), including SSN or ITIN, the TPSO or merchant acquirer must perform backup withholding under IRC § 3406(a). The withheld amounts must be reported on Form 945, Annual Return of Withheld Federal Income Tax, and reflected in Box 4 of Form 1099-K.

Entities can verify TINs using the IRS TIN Matching Program to prevent penalties and reduce erroneous withholding

5. De Minimis Exceptions and Penalties

Under IRC §§ 6721 and 6722, penalties apply for failure to file or furnish correct information returns. The OBBB provides relief to TPSOs by clarifying that they are not subject to penalties unless the gross payments exceed $20,000 and the number of transactions exceeds 200.

There is no de minimis exception for payment card transactions, which must always be reported

6. Avoiding Duplicate Reporting

If a payment is reportable under both IRC § 6041 (Form 1099-MISC or 1099-NEC) and § 6050W (Form 1099-K), the IRS clarifies that only Form 1099-K should be filed to avoid duplication

7. Information Required on Form 1099-K

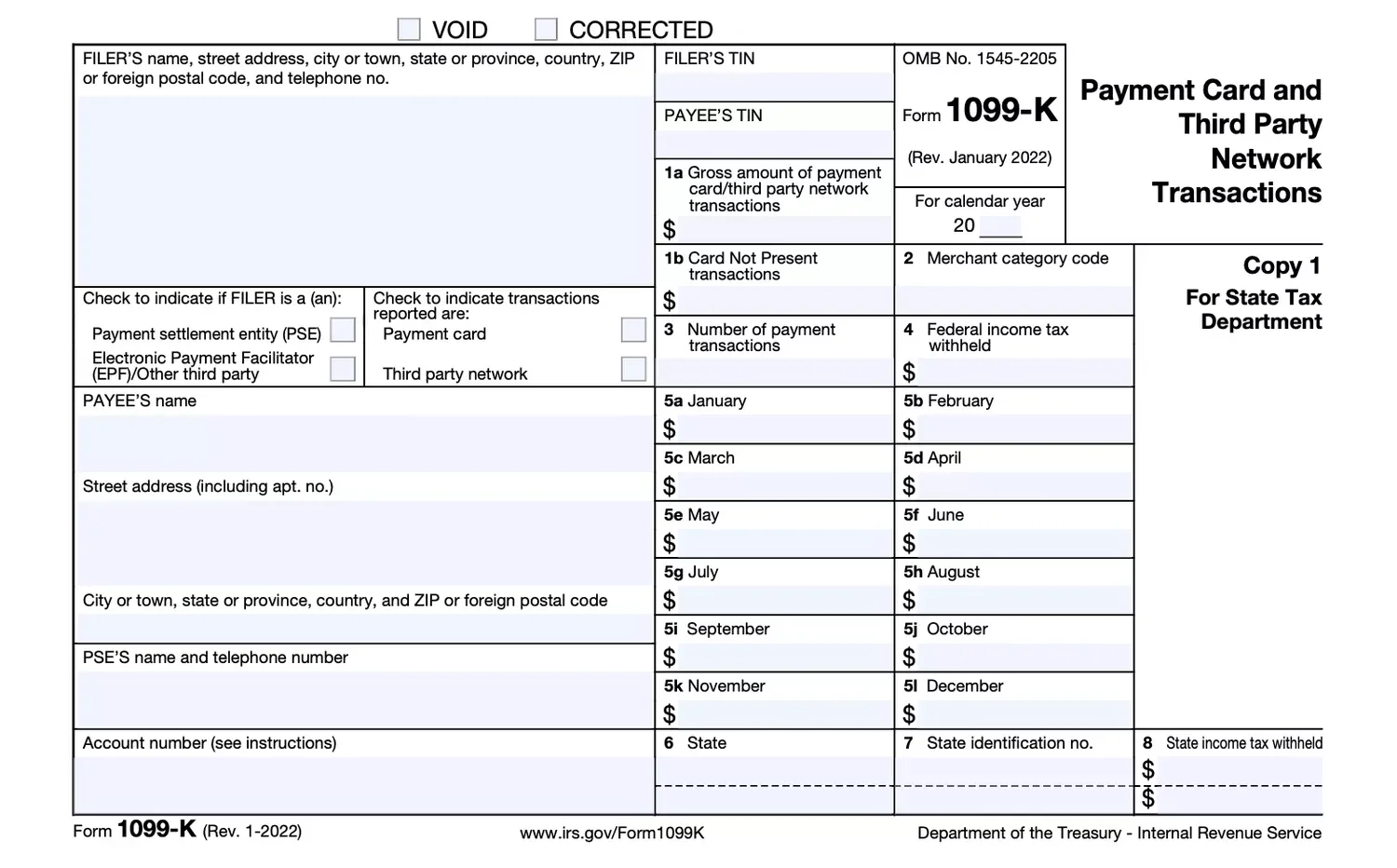

Each Form 1099-K must include:

Gross amount of reportable payment transactions (Box 1a)

Merchant Category Code (MCC) for merchant acquiring entities (Box 2)

Payee’s Taxpayer Identification Number (TIN)

Federal income tax withheld (Box 4, if applicable)

TPSOs do not need to complete Box 2 because they do not use MCCs to classify payees

8. How the OBBB Impacts Individuals and Businesses

Individuals and business owners using apps like Venmo, PayPal, or online marketplaces such as eBay and Etsy should note:

Form 1099-K is issued only when sales of goods or services exceed the federal threshold.

Personal transactions (such as gifts or reimbursements among friends and family) should not be reported.

Good recordkeeping is critical—separate personal and business accounts to avoid incorrect reporting and potential audits

9. Electronic Filing and Third-Party Preparation

A PSE may contract a third-party provider to prepare and file Forms 1099-K, but the original entity that submits the funds transfer instructions remains liable for any non-compliance penalties. They cannot charge payees fees for furnishing required statements

10. Special Considerations for Ticket Sales and Crowdfunding

The IRS emphasizes that income from ticket resales and crowdfunding is potentially taxable. Under Executive Order 14254 (Combating Unfair Practices in the Live Entertainment Market), ticket scalpers and resale platforms must comply fully with Form 1099-K reporting to ensure transparency and fair market practices

Need Assistance?

For expert assistance, contact JCox CPAs & Advisors, P.C. Our experienced tax professionals will guide you through each step from verifying FEMA eligibility to preparing amended or extended filings, ensuring you receive every available deduction and relief benefit with full IRS compliance.

Source: IR-2025-107, Oct. 23, 2025_ IRS Fact Sheet 2025-08